Project Overview

StudentFinance partners with schools to offer income share agreements (ISAs). With an ISA, a student doesn’t pay tuition up front. Instead, once they graduate and start working, they pay back a small percentage of their salary for a set period of time.

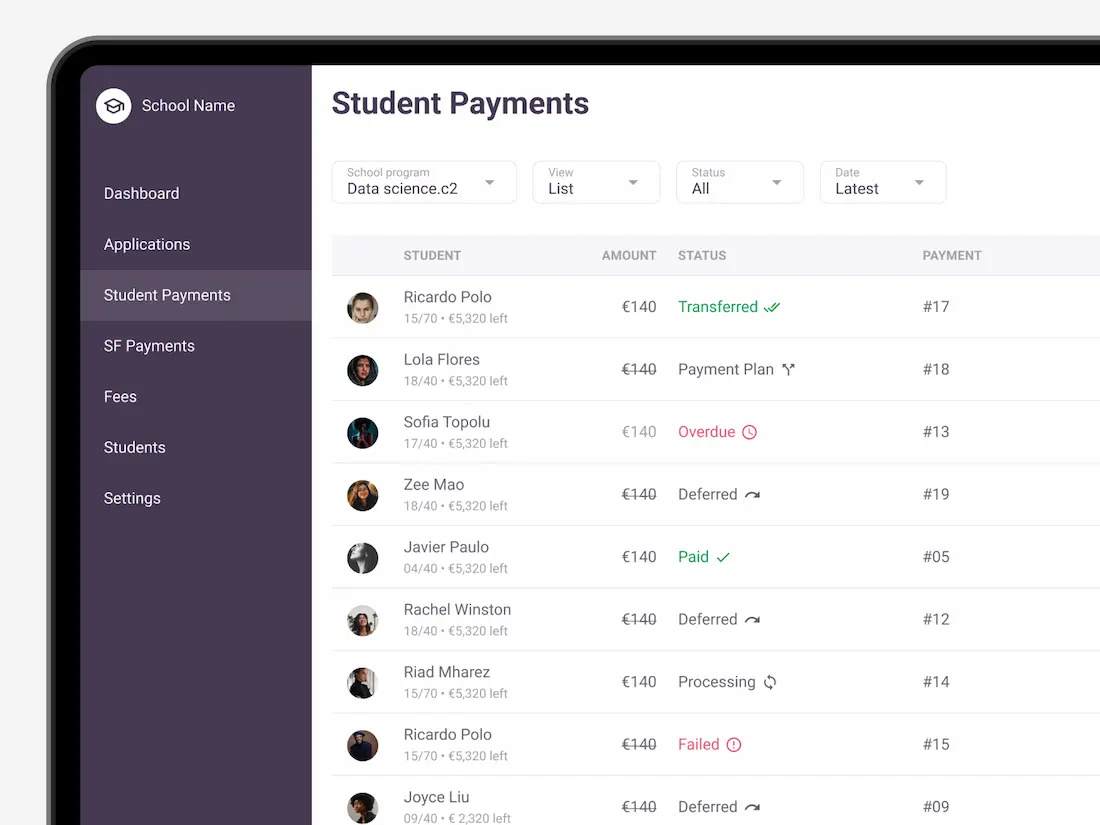

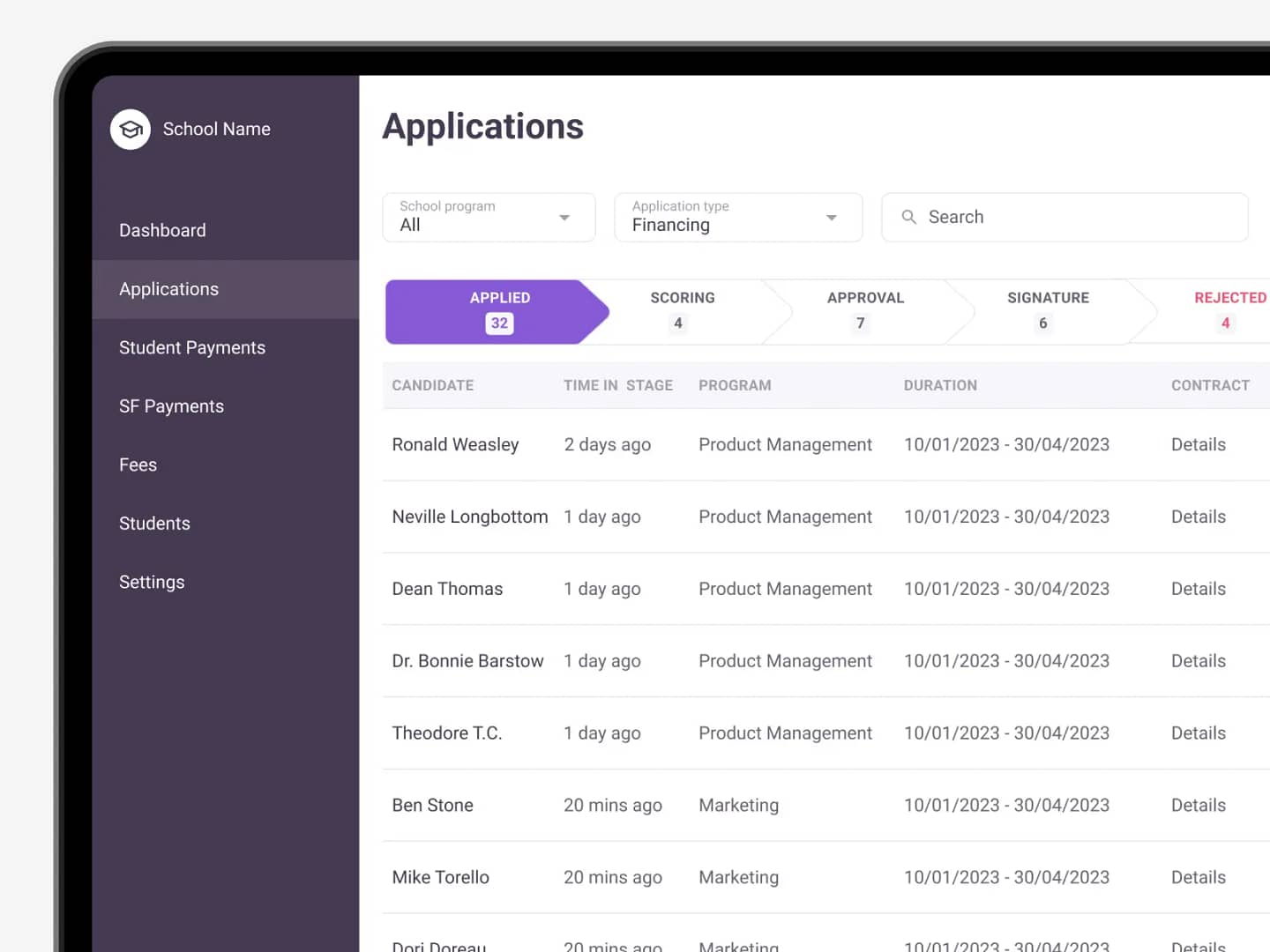

Partner schools were managing applications, payments, and student outcomes across spreadsheets, emails, and manual reports. This was messy, slow, and caused mistakes.